For many, the 2017 and 2018 wildfires were a wake-up call. Prior to 2017, the most destructive wildfire on record was the 1991 Oakland Hills fire. Until recently, it was easy to dismiss this incident as an anomaly, unlikely to occur again in the present day, due to improved technology, firefighting protocols, and wildland management. Unfortunately, the experience of the last two years stamped out such optimism.

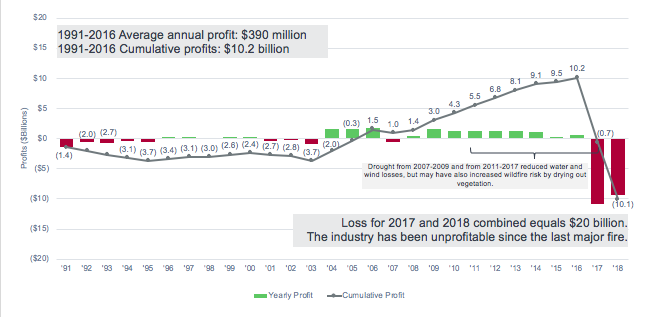

Excluding the effects of reinsurance or other recoveries, Milliman estimates that the 2017 wildfire season alone wiped out just over 10 years of underwriting profits for California homeowners insurers, and that the combined 2017 and 2018 wildfire seasons wiped out about twice the combined underwriting profits for the past 26 years, leaving the insurance industry with an aggregate underwriting loss of over $10 billion for the California homeowners line of business since 1991 (see Fig. 1).

Figure 1: California homeowner estimated industry profits since 1991

Source: Milliman Estimates, based on P&C Combined Industry Annual Statement data from SNL and data from the California Department of Insurance. Excludes impact of reinsurance and investment income.

Based on these losses, what has historically been considered a relatively profitable line of business without peak-peril catastrophic exposure, has recently become an unprofitable line exposed to a severe peril that is neither easily measured nor fully understood. As a result, wildfire risk has become a key focus of California property insurers.

Quantifying future wildfire risk

Insurance companies are swiftly reacting to this shift in perception via rate increases, non-renewals, underwriting restrictions, and rating plan modifications. Many companies have begun to file rate increase requests with the California Department of Insurance (CDI), which are grounded at least in part on increases to their long-term expectations of catastrophe loss. Using the method prescribed by California regulation, which mandates usage of a historical average based on a minimum of 20 years of data, some companies have doubled their expected catastrophe loss projections by including loss experience from the 2017 and 2018 fires. 1

However, pricing insurance for catastrophe risk based on historical experience can be problematic. As severe catastrophes can be rare, a 20-year period may not be sufficient to reflect the full range of plausible events. Insurer filings using only the most recent 20 years of catastrophe data implicitly assume that the 2017 and 2018 fires would occur twice in a 20-year period on average. However, fires of such magnitude are historically so infrequent that a 20-year period is unlikely to capture their long-term frequency. Additionally, insurer historical experience does not necessarily reflect current underlying conditions, such as dry vegetation from recent drought, increased housing units built in the wildland urban interface (WUI), or any other changes to the insurer’s risk exposures over time. With the further complicating factor that insurers are not permitted to reflect net reinsurance costs in their overall rates, current regulations could potentially cause a material gap between insurers’ estimates of losses and expenses and the corresponding rates that they charge.

As an alternative to relying solely on historical experience, stochastic catastrophe simulation models, or “cat models,” draw from fields like atmospheric science, environmental science, actuarial science, and engineering, and have been developed for a variety of catastrophic perils, such as hurricanes, floods, winter storms, earthquakes, and wildfires, to address many of the shortcomings associated with the use of insurers’ historical averages. These models simulate catastrophic events based on their key drivers, which in the case of wildfires include vegetation type, topography, and wind conditions. Users of these cat models are able to estimate average annual losses and probable maximum losses, and simulate probability distributions of insured loss for an entire insured book of business as well as an individual property. These models have gained acceptance among insurers, reinsurers, ratings agencies, and other stakeholders evaluating catastrophic risk.

Outside of earthquake-related perils, however, California’s prescribed pricing procedures limit the use of cat models. Still, a number of firms have created proprietary, commercially available cat models for wildfire. The fact that regulatory adaptation has been slow is not unexpected; wildfire modeling is a complex task, and regulators have reason to evaluate before accepting these models as reliable. We delve further into the complexity of creating wildfire cat models later in this paper, through a Q&A with select modeling firms (see “A view from catastrophe modelers”). But Dag Lohmann, CEO of KatRisk, LLC, noted,

“Current models for fuel, spread, damage from smoke, damage from embers, mitigation, etc. all result in 10 to 15 free model parameters that need to be tuned to historical data. Multiple modelers could develop a wildfire model from all the components in current literature, tune the models to reasonably validate with historical data, and ultimately have average annual losses 2 or 3 times different than each other when projecting future losses. […] Multiple Ph.D. theses can be written on individual components of spread, fuel, ignition, correlation between climate and lightning, etc.”

This candid description of variability in cat modeling evokes the thinking of statistician George Box, who quipped that “All models are wrong, some are useful.” In other words, a good model can provide users with significant value in spite of outstanding uncertainties as to model precision. Model validation, as well as rigorous review of model operations and assumptions, are critical steps in assessing whether this value can be extracted from a cat model, given its intended use.

Paired with a change to existing regulations, widespread validation and use of wildfire cat models could be beneficial to California homeowners. As a result of the current regulatory environment, insurers may not be able to charge rates consistent with their estimations of risk, which causes them to manage their portfolios by other means, such as non-renewing customers, limiting coverage, or restricting availability to new customers. Enhanced pricing for wildfire risk could mitigate the impact of non-renewals and new business restrictions by allowing insurers to achieve a better alignment of premiums to perceived risk and to manage risk concentrations. Benefiting consumers more directly, cat models can be used to estimate the value of mitigation features, which can be reflected in insurance prices, inducing homeowners and communities to take actions to reduce the risk to their properties.

Mitigation modeling

Because cat models are able to simulate expected losses for individual risks, given basic property attributes such as construction type and location, they can be used to create pricing and underwriting plans that can recognize mitigation measures. These plans represent an improvement upon those using wildfire risk-scoring models, which consider elements of wildfire risk at a particular geographic area, but stop short of considering the actual characteristics of the property or how the risk could be affected by a change in those characteristics.

By recognizing mitigation features in the modeling process, insurers can calculate discounts for homeowners who mitigate risk. For wildfire, this includes features such as fire-resistive siding, specific roofing materials, and landscaping mitigation. For example, CoreLogic and AIR explicitly reflect community and homeowner mitigation characteristics in their models.

In Florida, insurers are mandated by state law to offer credits for wind mitigation features, such as tie-downs for roofing materials and coverings for windows or doors. 2 Accordingly, the state commissioned a study in 2002 in which the secondary characteristics of a particular model were used to estimate these credits. The results of this 2002 study were made available to insurers to incorporate in their rating plans for compliance, and a further update was made available in 2008. As no state-sponsored studies have been released since, many insurers have used more recent models to estimate customized, more granular wind mitigation credits than those offered by the state-sponsored study. To provide incentives for wildfire mitigation, California officials could consider a similar course of action to the one undertaken in Florida.

One hurdle still remains for implementing mitigation discounts and for reliably modeling property-level wildfire risk: data availability. Insurers have historically collected or estimated property features such as construction material, year built, and replacement cost. However, other more specific and often critical elements such as the age, type or condition of the roof, date of the last renovation, defensible space, or presence of ember-resistive vents are either unreliably self-reported by consumers or omitted entirely from the rate-setting process. Insurance companies often conduct inspections, but this is a time and labor-intensive exercise unlikely to cover every building in a given insurer’s portfolio. Therefore, insurers may not yet possess the data necessary to appropriately estimate and offer wildfire mitigation discounts today. However, such data is progressively becoming more available over time. According to cat modelers we’ve spoken to at CoreLogic, Inc., “For hurricane and earthquake modeling, it took several years for the industry to capture the data that was already usable in catastrophe models. The industry needs to capture more data to fully take advantage of wildfire models.”

As data availability improves, mitigation discounts could be a catalyst to a beneficial feedback loop, not only for data collection but also for wildfire resilience. As more companies offer discounts for risk mitigation, customers will have a greater incentive to install features to reduce the risk to their homes. As mitigation features become more prevalent, more insurers may be forced to offer these discounts in order to remain competitive.

Although their perspectives on wildfire risk management are not always aligned, insurers, regulators, and consumers can find common ground around the benefit of catastrophe models. This could lead to greater acceptance and use of models – which could spur further review, development, and improvement.

CORELOGIC MITIGATION FEATURES

| Roofing fire class |

| Three zones of clearance |

| Fire-resistive siding |

| Automatic external fire extinguishing |

| Combustible attachments |

| Fire-resistive windows and doors |

| Structure fire vulnerability mitigation |

| Community fire awareness |

A view from catastrophe modelers

A number of firms have created proprietary, commercially available cat models. To provide a better understanding of wildfire cat models, we reached out to three cat modeling firms and asked them to share their views on wildfire modeling, reactions to the recent wildfire seasons, and predictions for the future. Below are responses from AIR Worldwide (a subsidiary of Verisk Analytics, Inc.), KatRisk, LLC, and CoreLogic, Inc., about wildfire modeling (comments edited for brevity when necessary).

Question: What was your reaction to the 2017 and 2018 fires? Did anything surprise you?

AIR, KatRisk, and CoreLogic generally agreed that the magnitude of wildfires in 2017 and 2018 was not surprising, based on contemporary scientific understanding of the risk.

AIR:“Although the events of 2017 and 2018 were a surprise to the industry, they were not unexpected by AIR’s model. […] Butte County has a long history of wildfire activity: Paradise had been threatened by many historical wildfires and is impacted several times in our model. Ember generation, the primary method by which fires spread into the WUI and even reach urban areas in extreme scenarios, is captured explicitly in the AIR model.”

KatRisk:“The last two years were extreme, but not surprisingly so. Our knowledge about wildfires has not changed based on those years. Extremes are rare but expected.”

CoreLogic:The Woolsey, Thomas, Carr, and Camp Fires all occurred not only in regions where we know there to be disproportionately large areas of high wildfire risk, but also in areas where it was clear there could be devastating losses due to the proximity of risk to the residential and business development in and around the area. […] It was probably more surprising that these fires did not occur earlier, during the most intense conditions created by the drought.”

CoreLogic also noted that its modeled estimates for the Tubbs fire ranged from $6 billion to $7 billion, consistent with CDI claims data close to $7 billion. They estimate that an event of that magnitude would occur an average every 25 to 30 years in California, given the exposure at the time of the event.

Question: Are there geographic areas or certain home characteristics with significant risk for which public awareness may be lacking?

AIR:“The 2017 events, and particularly the Tubbs fire, saw many people that didn’t believe they were at risk from wildfire losses to their homes, particularly in the Coffey Park area of Santa Rosa. This area had not been deemed a high-risk wildfire area by the public due to it being separated from wildland by Highway 101. However, it was still within reach of embers that were able to cross the highway and ignite homes in the neighborhood.

Public awareness of wildfire risk has certainly improved over the last two years, but there is still additional room for improvement. Ember generation is the primary driver of structure ignition from wildfires, and there are ways to minimize risk with proper planning through the creation of defensible space. Ensuring that wildfire risk is considered when planning new developments and enforcing appropriate building codes in those areas will also be important moving forward.”

CoreLogic: “All hazards have some risk amnesia and wildfire is no different. After a number of years without an event, communities and individuals may be less proactive to mitigate. […] Defensible space and roof material are two most cited mitigation features. However, there seems to be less awareness for items like mesh screens over attic vents. IBHS research has revealed that lesser known items are not necessarily less important – items like clearing eaves and roofs and covered soffits can be very effective at reducing risk.”

Question: What major uncertainties still exist with modeling wildfires?

AIR: “The largest uncertainty within wildfire modeling is the human aspect – where will ignitions occur and how far into the WUI will the fire be able to spread based on the effectiveness of the suppression resources available in the conditions presented. This is true within our model as well.”

CoreLogic: “[There are two problems, the first being] the inability to model irresponsible human behavior as it relates to wildfire ignitions. Modeling lightning strikes would be infinitely easier. [By comparison, human] irresponsibility is infinitely variable.

[Additionally,] pyroclimate – the weather developed by the fire itself. Modeling a fire’s progression based on the changing meteorological factors that are driven by the fire, such as winds, is very difficult. Mostly from the wind changing due to the fire’s internal factors. Models will need to be broadened significantly to fully incorporate pyroclimatic features.”

Closing

Well-designed cat models represent a significant improvement over the sparse historical record in the reliability and rigor of quantifying risk. However, model results can vary significantly from modeler to modeler due to the complexity of the peril being modeled, the varying approaches taken by each modeler, and the data available to those doing the modeling. It would be inappropriate to assume that all cat models, including those covering wildfires, are appropriate for any application.

However, when used responsibly with a requisite amount of model review and validation, the value of wildfire models is clear – they can bridge the gap between peer-reviewed science and observed losses from historical events, and can provide enhanced quantification and understanding of future wildfire risk. As such, they could provide significant utility to insurers, regulators, and consumers, which will only improve as modelers continue to refine their products.

1Based on Milliman studies of California rate filings.

2Florida Statutes, 627.0629.

Any quotations from AIR Worldwide, KatRisk, LLC, and CoreLogic, Inc. were provided by representatives of the respective companies and do not necessarily represent any opinion of Milliman. Any other statements in this paper do not necessarily reflect the opinions of AIR Worldwide, KatRisk, LLC, or CoreLogic, Inc. We thank AIR Worldwide, KatRisk, LLC, and CoreLogic, Inc. for their contributions to this article.