Milliman analysis: Funded status improves by $15 billion in November

The Milliman 100 PFI funded ratio increases to 86.8% primarily due to investment gains

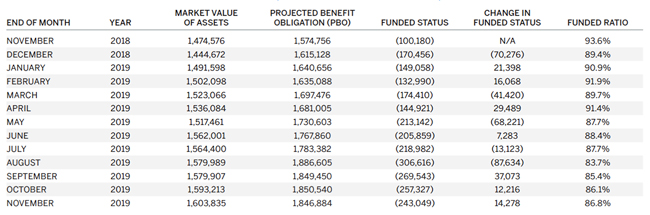

The funded status of the 100 largest corporate defined benefit pension plans increased by $15 billion during November as measured by the Milliman 100 Pension Funding Index (PFI). The deficit lessened to $243 billion primarily due to investment gains. Benchmark corporate bond interest rates used to value pension liabilities were flat in November, as they were in October. As of November 30, the funded ratio increased to 86.8%, from 86.1% reported at the end of October. Pension funding has improved by $64 billion over the past three months primarily due to positive market performance.

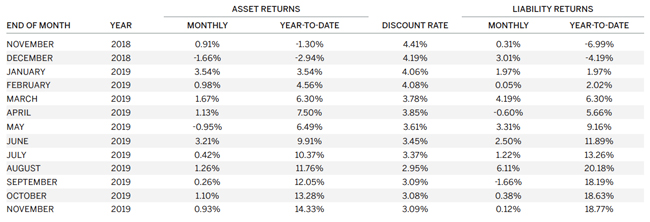

The market value of assets improved by $11 billion as a result of November’s 0.93% investment gain. The Milliman 100 PFI asset value increased to $1.604 trillion from $1.593 trillion at the end of October. By comparison, the 2019 Milliman Pension Funding Study reported that the monthly median expected investment return during 2018 was 0.53% (6.6% annualized).

HIGHLIGHTS

| $ BILLION | ||||

| MV | PBO | FUNDED STATUS | FUNDED PERCENTAGE | |

| OCTOBER | 1,593 | 1,851 | (258) | 86.1% |

| NOVEMBER | 1,604 | 1,847 | (243) | 86.8% |

| MONTHLY CHANGE | +11 | (4) | +15 | 0.7% |

| YTD CHANGE | +159 | +232 | (73) | -2.6% |

| Note: Numbers may not add up precisely due to rounding | ||||

The projected benefit obligation (PBO) decreased by $4 billion during November, lowering the Milliman 100 PFI value to $1.847 trillion from $1.851 trillion at the end of October. The change was the result of a one basis point increase in the monthly discount rate, to 3.09% for November from 3.08% in October. Discount rates have been flat over the past two months and continue to rank among the lowest ever recorded in the 19-year history of the Milliman 100 PFI.

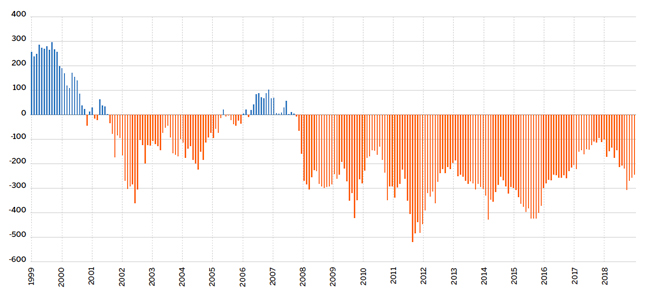

FIGURE 1: MILLIMAN 100 PENSION FUNDING INDEX PENSION SURPLUS/DEFICIT

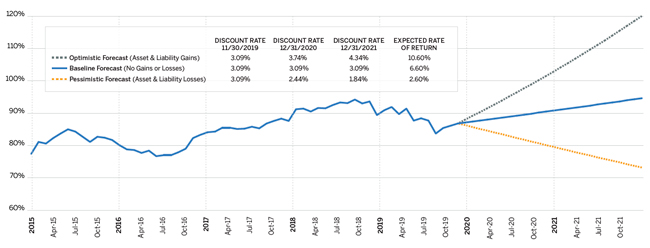

FIGURE 2: MILLIMAN 100 PENSION FUNDING INDEX — PENSION FUNDED RATIO

Over the last 12 months (December 2018–November 2019), the cumulative asset return for these pensions has been 12.44% and yet the Milliman 100 PFI funded status deficit has worsened by $143 billion. The primary reason for the widening of the funded status deficit during this time period has been discount rate declines. Discount rates fell from 4.41% as of November 30, 2018 to 3.09% a year later. The funded ratio of the Milliman 100 companies has decreased significantly over the past 12 months, to 86.8% from 93.6%. We will continue to closely monitor the movement of the financial markets and the interest rate environment as year-end approaches.

2019-2021 Projections

If the Milliman 100 PFI companies were to achieve the expected 6.6% median asset return (as per the 2019 pension funding study), and if the current discount rate of 3.09% were maintained during the remaining month of 2019 through the end of 2021, we forecast that the funded status of the surveyed plans would increase. This would result in a projected pension deficit of $169 billion (funded ratio of 90.8%) by the end of 2020 and a projected pension deficit of $98 billion (funded ratio of 94.6%) by the end of 2021. For purposes of this forecast, we have assumed 2020 and 2021 aggregate annual contributions of $50 billion.

Under an optimistic forecast with rising interest rates (reaching 3.74% by the end of 2020 and 4.34% by the end of 2021) and asset gains (10.6% annual returns), the funded ratio would climb to 103% by the end of 2020 and 120% by the end of 2021. Under a pessimistic forecast with similar interest rate and asset movements (2.44% discount rate at the end of 2020 and 1.84% by the end of 2021 and 2.6% annual returns), the funded ratio would decline to 80% by the end of 2020 and 73% by the end of 2021.

MILLIMAN 100 PENSION FUNDING INDEX — NOVEMBER 2019 (ALL DOLLAR AMOUNTS IN MILLIONS)

PENSION ASSET AND LIABILITY RETURNS

About the Milliman 100 Monthly Pension Funding Index

For the past 19 years, Milliman has conducted an annual study of the 100 largest defined benefit pension plans sponsored by U.S. public companies. The Milliman 100 Pension Funding Index projects the funded status for pension plans included in our study, reflecting the impact of market returns and interest rate changes on pension funded status, utilizing the actual reported asset values, liabilities, and asset allocations of the companies’ pension plans.

The results of the Milliman 100 Pension Funding Index were based on the actual pension plan accounting information disclosed in the footnotes to the companies’ annual reports for the 2018 fiscal year and for previous fiscal years. This pension plan accounting disclosure information was summarized as part of the Milliman 2019 Pension Funding Study, which was published on April 16, 2019. In addition to providing the financial information on the funded status of U.S. qualified pension plans, the footnotes may also include figures for the companies’ nonqualified and foreign plans, both of which are often unfunded or subject to different funding standards than those for U.S. qualified pension plans. They do not represent the funded status of the companies’ U.S. qualified pension plans under ERISA.