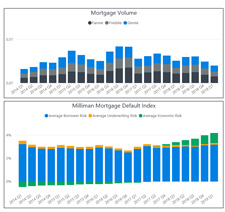

Default risk of government-backed mortgages decreases once again in 2019 Q3 as refinance borrowers continue to take advantage of low interest rates

The Milliman Mortgage Default Index (MMDI) is a lifetime default rate estimate calculated at the loan level for a portfolio of single-family mortgages. For the purposes of this index, default is defined as a loan that becomes 180 days delinquent or worse1. The results of the MMDI reflect the most recent data acquisition available from Freddie Mac, Fannie Mae, and Ginnie Mae, with measurement dates starting from January 1, 2014.

Interact with the MMDI

To explore the MMDI data on a more granular level, including loan origination and type, click here.

Key findings: 2019 Q3

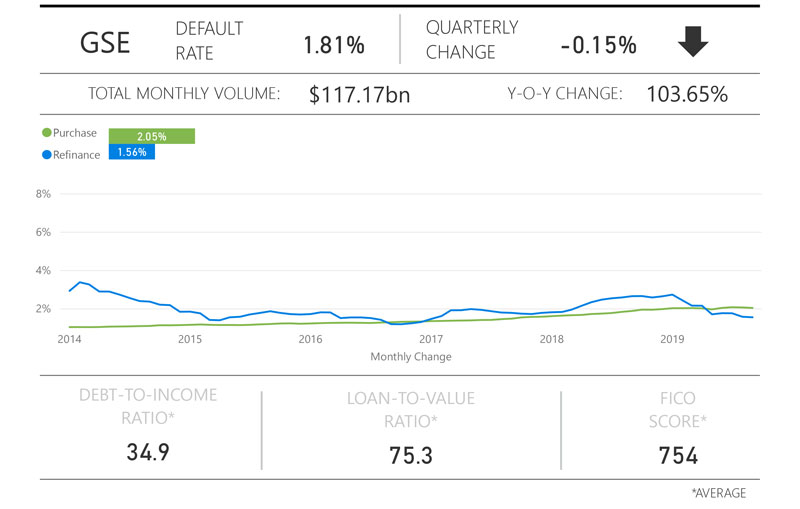

During the third quarter of 2019, the MMDI for government-sponsored enterprise (GSE) acquisitions (loans acquired by Freddie Mac and Fannie Mae) decreased, dropping from 1.96% in Q2 to 1.81% for loans originating in Q3. Figure 1 provides the quarter-end index results for these loans segmented by purchase and refinance. Like the previous quarter, the Q3 decrease is largely driven by low-risk refinance borrowers once again taking advantage of the drop in interest rates. Refinance loans tend to have lower loan-to-value (LTV) ratios relative to purchase loans.

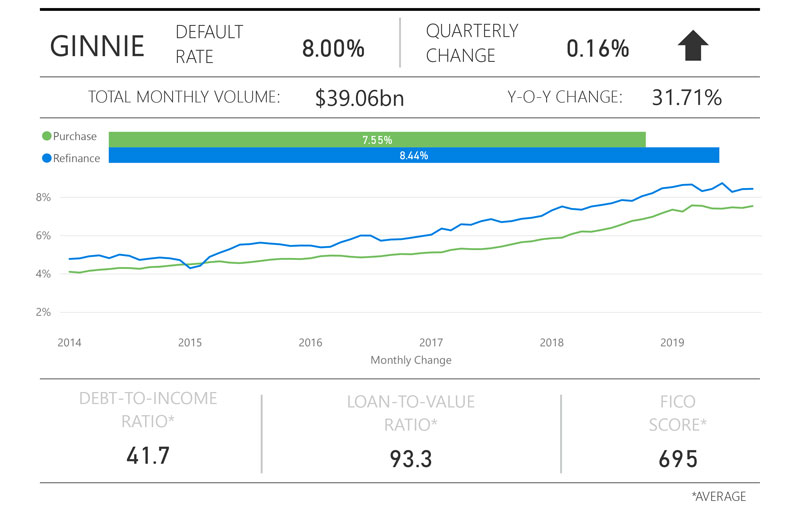

The MMDI for Ginnie Mae loans increased from 7.84% in Q2 to 8.00% in Q3 as can be seen in Figure 3 (segmented by purchase and refinance). The increase in the MMDI for Ginnie Mae loans is consistent with a continuation of the trend for prior origination quarters, with Ginnie Mae continuing to experience credit score drift relative to GSE acquisitions.

The MMDI for Ginnie Mae loans increased from 8.09% in Q1 to 8.15% in Q2. The increase in the MMDI for Ginnie Mae loans is consistent with and a continuation of the trend for prior origination quarters.

Figure 1 shows a summary of the latest MMDI. Figure 1 is segmented by loan purpose and filtered to GSE loans.

FIGURE 1: MMDI DASHBOARD FOR GSE LOANS

Figure 2 summarizes default rates during the global financial crisis for a comparison of how rates look during an extreme scenario.

FIGURE 2: SUMMARY OF DEFAULT RATES DURING GLOBAL FINANCIAL CRISIS

| Origination Quarter | Purchase | Refinance |

|---|---|---|

| 10/1/2007 | 1/1/2008 | 4/1/2008 |

| 16.76% | 14.25% | 13.01% |

| 11.52% | 8.64% | 9.17% |

Figure 3 shows a summary of the latest MMDI. Figure 3 is segmented by loan purpose and filtered to Ginnie loans.

FIGURE 3: MMDI DASHBOARD FOR GINNIE LOANS

Agency differences

Freddie and Fannie acquisitions experienced a decreased risk profile over the prior three months. Most of the decrease is attributable to higher borrower credit quality as a function of an increased refinance market (which tends to have lower LTVs).

The credit risk of loans guaranteed by Ginnie Mae continue to experience an uptick in their default risk, which is consistent with the overall increasing trend that has occurred since 2014. Specifically, as the GSE’s have opened underwriting guidelines, higher credit quality originations have shifted towards GSE loans and away from Ginnie Mae loans.

Note that the results above do include upward pressure as a result of economic risk for all investors (Freddie, Fannie, and Ginnie). Our models estimate a slowdown in home price growth relative to prior years, which puts upward pressure on mortgage default risk. If actual home price growth differs from these projections, the MMDI will adjust accordingly in future publications.

Components of default risk

The components of the MMDI that inform default risk are borrower risk, underwriting risk, and economic risk. Borrower risk measures the risk of the loan defaulting due to borrower credit quality, initial equity position, and debt-to-income ratio. Underwriting risk measures the risk of the loan defaulting due to mortgage product features such as amortization type, occupancy status, and others. Economic risk measures the risk of the loan defaulting due to historical and forecasted economic conditions.

Borrower risk results: 2019 Q3

During Q3, borrower risk has decreased across all investor and loan types. With the decline in interest rates, rate/term refinance originations increased significantly. As borrowers refinance, they tend to do so at lower LTV ratios (with a cash-out refinance now being capped at 80% across all agencies), which reduces the credit risk of the underlying mortgages.

Underwriting risk results: 2019 Q3

Underwriting risk represents additional risk adjustments for property and loan characteristics such as occupancy status, amortization type, documentation types, loan term, and others. Underwriting risk after the global financial crisis remains low and is negative for purchase mortgages, which were generally full documentation, fully amortizing loans. In 2019 Q3, we have seen an increase in the percent of refinance loans that are rate/term. This loan type has a lower risk profile relative to cash-out refinance mortgages.

Economic risk results: 2019 Q3

Economic risk is measured by looking at historic and forecasted home prices. Actual home price appreciation has been robust from 2014 through 2019 which has resulted in embedded appreciation for older originations. This results in reduced credit risk for older cohorts. For more recent cohorts, we have observed and continue to anticipate slower home price growth (or negative growth for some local geographies), which contributes to increases in economic risk for recent origination years.

About the Milliman Mortgage Default Index

Milliman is proficient in analyzing complex data and building econometric models that are transparent, intuitive, and informative. We have used our expertise to assist multiple clients in developing econometric models for evaluating mortgage risk both at point of sale and for seasoned mortgages.

The Milliman Mortgage Default Index (MMDI) uses econometric modeling to develop a dynamic model that is used by clients in multiple ways including analyzing, monitoring, and ranking the credit quality of new production, allocating servicing sources, and developing underwriting guidelines and pricing. Because the MMDI produces a lifetime default rate estimate at the loanlevel, it is used by clients as a benchmarking tool in origination and servicing. The MMDI is constructed by combining three important components of mortgage risk: borrower credit quality, underwriting characteristics of the mortgage, and the economic environment presented to the mortgage. The MMDI was developed, and is frequently updated, using a robust dataset of over 30 million mortgage loans.

Milliman is one of the largest independent consulting firms in the world and has pioneered strategies, tools and solutions worldwide. We are recognized leaders in the markets we serve. Milliman insight reaches across global boundaries, offering specialized consulting services in mortgage banking, employee benefits, healthcare, life insurance and financial services, and property and casualty insurance. Within these, Milliman consultants serve a wide range of current and emerging markets. Clients know they can depend on us as industry experts, trusted advisers, and creative problemsolvers.

Milliman's Mortgage Practice in Milwaukee is dedicated to providing strategic, quantitative, and other consulting services to leading organizations in the mortgage banking industry. Past and current clients include many of the nation's largest banks, private mortgage guaranty insurers, financial guaranty insurers, institutional investors, and governmental organizations.

1For example, if the MMDI is 10%, then we expect 10% of the mortgages originated in that month to have become 180 days delinquent or worse over its lifetime