State Medicaid agencies may experience a substantial increase in Medicare Part B premiums and cost sharing they pay on behalf of individuals qualified for both Medicaid and Medicare (dual eligibles) in calendar year 2016. The Medicare Part B premium and deductible is reviewed annually by CMS, addressing inflation and other cost factors. In recent years, there have been limited changes to either the premium or deductible, with the last change occurring in 2013.

This year, however, preliminary estimates indicate the increase will be higher than the cost of medical inflation alone—and a quirk in the laws may require the increase to be spread unevenly among beneficiaries, at least for this year. Medicaid agencies that pay Medicare Part B premiums and cost sharing on behalf of dual eligibles, for example, could see sizeable increases. This year’s premium increase, if it were spread equally across all beneficiaries, is expected to be in the range of 15%. However, because of certain provisions in the Social Security Act, only about 30% of all beneficiaries would bear the brunt of this year's increase. These beneficiaries are currently facing increases of over 50% to their Part B premiums and deductible.1 Medicaid agencies currently pay the Medicare Part B premiums for approximately 10.7 million dual eligible beneficiaries and additionally pay the cost sharing for approximately 9.1 million of those beneficiaries2, so this increase could result in substantial additional Medicaid program spending.

The current situation

Two related requirements of Section 1839 of the Social Security Act have produced the current situation. In accordance with Section 1839, the revenue generated by Part B premiums is required to be 25% of the total cost of the program,3 which means that premiums rise and fall with the costs of the program, including normal adjustments for inflation. At the same time, another provision in Section 1839, known as the hold-harmless provision, precludes certain Social Security recipients from being required to pay more in Part B premium increases than their cost-of-living adjustment for that year.4

Because the cost-of-living increase this year is expected to be 0%, anyone who pays Part B premiums through a deduction to his/her Social Security benefits must also see a commensurate 0% increase to those premiums. This affects about 70% of Medicare Part B beneficiaries. The remaining 30% are facing an increase in those premiums of 52% this year.1 This group includes higher income individuals who pay income-related premiums, individuals newly enrolled in Medicare Part B, and dual eligibles.4 Dual eligibles are not covered by the hold-harmless provision because they do not pay their Medicare Part B premiums through a reduction to their Social Security benefits; the premiums are paid on their behalf by Medicaid agencies.

The estimated higher than normal aggregate premium increase this year (15%) is related in part to passage of the Medicare Access and Children's Health Insurance Program (CHIP) and Reauthorization Act of 2015 (MACRA), which revised some of the terms of Medicare physician reimbursement. In addition, evidence of higher than anticipated Medicare Part B program expenditures in 2014 and an increase in the healthcare cost trends projected by CMS contributed to the estimated increase.1

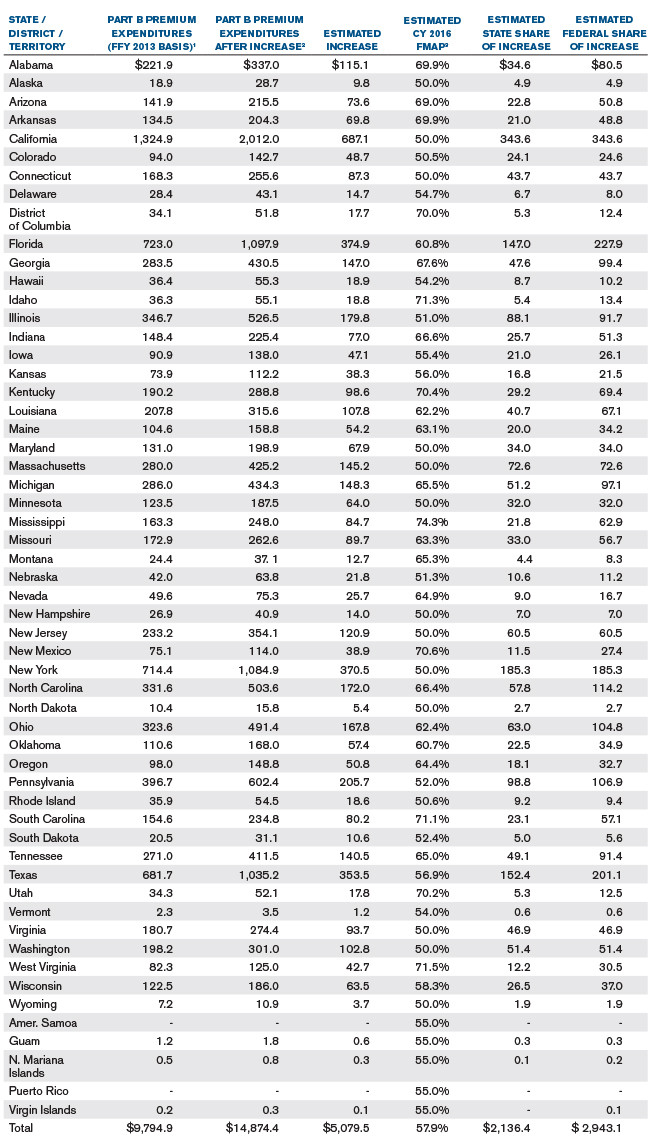

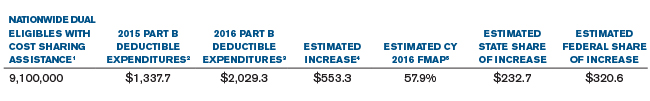

Figure 1 illustrates a high-level estimate of the potential Medicare Part B premium increase that may be incurred by Medicaid programs nationwide. The calendar year 2016 estimated impact was developed from Federal Fiscal Year (FFY) 2013 reported expenditures. Therefore, the estimated increase is relative to a FFY 2013 expenditure basis.

Figure 1 Notes

1. Federal Fiscal Year 2013 Medicare Part B Premiums were downloaded from medicaid.gov.9 Premiums paid on behalf of qualifying individuals (QIs) were excluded; these premiums are 100% federally funded.

2. Assuming a 52% increase following the increase of monthly Medicare Part B premiums from $104.90 to $159.30.

3. Based on Federal Fiscal Years 2016 and 2017 FMAPs from Federal Funds Information for States issue briefs. 6,7

4. Values have been rounded.

Attachment 1 expands on Figure 1 by illustrating the estimates on a state-by-state basis.

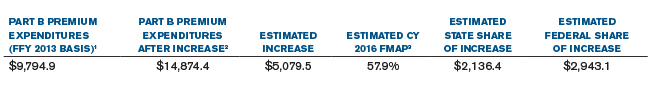

Historical Medicare Part B premium increases

An analogous situation occurred in 2010, although the expected increase in premiums this year is higher than it was in 2010. In 2010, there was a 0% increase in the cost-of-living adjustment. The same subset of beneficiaries were precluded from paying Part B increases, and as is expected this year, the remaining beneficiaries bore the disproportionate brunt of the increase. The 2010 increase on the subset of beneficiaries, however, was much smaller at approximately 15% compared with the 52% expected this year. There was again a 0% cost-of-living adjustment in 2011, but in 2012, there was a cost-of-living increase that was great enough to enable CMS to increase premiums for individuals protected under the hold-harmless provision to be consistent with the other Medicare Part B beneficiaries, a kind of premium reset. Figure 2 illustrates the historical monthly Medicare Part B premiums paid by Medicaid agencies on behalf of dual eligible beneficiaries.

Figure 2 Notes

1. Intermediate estimate from the 2015 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds report.5

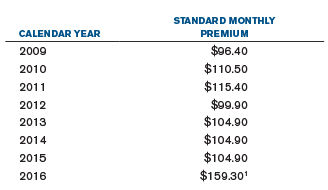

Medicare Part B deductible

In addition to the premium increase, the Medicare Part B annual deductible is also projected to increase by 52% for Medicare Part B beneficiaries, from $147 to $223.5 Medicaid agencies pay the Medicare cost sharing for certain dual eligible individuals and would, therefore, see increases in their Medicare cost sharing expenditures to the extent their beneficiaries’ healthcare expenditures are above $147. The coinsurance for Medicare Part B, however, will remain consistent with previous years at 20%.

The following table shows a high-level illustration of the potential increase in Medicaid agency expenditures attributable to an increase in the Medicare Part B deductible for dual eligibles with cost-sharing assistance.

Figure 3 Notes

1. The number of dual eligibles with cost sharing assistance is estimated using the reported number of full benefit dual eligibles and the percentage of QMB-only beneficiaries for 2013 in a Medicare-Medicaid Coordination Office data analysis brief2. Medicaid agencies only pay cost sharing amounts (including the deductible) for dual eligibles in these eligibility categories.

2. The estimated 2015 expenditures assume that every dual eligible with cost sharing assistance incurs the full cost of the 2015 deductible ($147). No increase in enrollment from 2013 was assumed.

3. The estimated 2016 expenditures assume that every dual eligible with cost sharing assistance incurs the full cost of the projected 2016 deductible ($223). No increase in enrollment from 2013 was assumed.

4. The increase in expenditures was estimated as 80% multiplied by the difference in the estimated 2015 and 2016 Part B deductible expenditures. The 80% factor adjusts for the additional estimated cost incurred between $147 and $223 under the 2016 deductible level.

5. Based on Federal Fiscal Years 2016 and 2017 FMAPs from Federal Funds Information for States issue briefs. 6,7

6. Values have been rounded.

Looking forward

The actual 2016 premium is still unknown at this point and is generally released by the U.S. Department Health and Human Services (HHS) in mid- to late October. According to an HHS press conference on July 22, 2015, the final 2016 premiums will depend on the preliminary projections combined with any emerging data as well as HHS policy decisions.8 Additionally, the final cost-of-living adjustment for 2016 has not been released at this time. To the extent the adjustment is greater than 0%, the cost increase of the Medicare Part B program will be distributed more evenly over all Medicare Part B beneficiaries. Contact your Milliman consultant or other professionals for more insight into how this situation may affect you.

LIMITATIONS AND DATA RELIANCE

The materials in this document represent the opinion of the authors and are not representative of the views of Milliman, Inc. Milliman does not certify the information nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman.

QUALIFICATIONS

Guidelines issued by the American Academy of Actuaries require actuaries to include their professional qualifications in all actuarial communications. The authors are members of the American Academy of Actuaries, and meet the qualification standards for performing the analyses in this report.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge Justin Birrell, FSA, MAAA, principal and consulting actuary in the Seattle office of Milliman, for his peer review and comments during the writing of this report.

Additionally, the authors express gratitude to the health actuarial staff in the Indianapolis office of Milliman for their statistical support during the writing of this report.

1The 2015 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, pp. 32-33. Retrieved October 1, 2015, from https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/reportstrustfunds/downloads/tr2015.pdf.

2Medicare-Medicaid Coordination Office (December 2014). Data Analysis Brief: Medicare-Medicaid Duel Enrollment From 2006 Through 2013, p. 14. Retrieved October 1, 2015, from https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/Downloads/DualEnrollment20062013.pdf.

3Social Security Act, Section 1839(a). Retrieved October 1, 2015, from https://www.socialsecurity.gov/OP_Home/ssact/title18/1839.htm.

4Social Security Act, Section 1839(f). Retrieved October 1, 2015, from https://www.socialsecurity.gov/OP_Home/ssact/title18/1839.htm.

52015 Trustees Report, ibid., p. 203.

6Tomsic, T. (2014). Final FY 2016 FMAPs. Federal Funds Information for States, 14(32), 8-8.

7Tomsic, T. (2015). FY 2017 FMAPs Increase in 25 states, decline in 12. Federal Funds Information for States, 15(31), 9-9.

88. Burwell, S.M. (July 22, 2015). Medicare and Social Security Spring Trustees Press Conference. Retrieved October 1, 2015, from http://www.hhs.gov/about/leadership/secretary/speeches/2015/medicare-and-social-security-spring-trustees-press-conference.html.

99. Medicaid.gov. Expenditure Reports from MBES/CBES. Retrieved October 1, 2015, from http://medicaid.gov/medicaid-chip-program-information/by-topics/financing-and-reimbursement/expenditure-reports-mbes-cbes.html.

Attachment 1 Notes

1. Federal Fiscal Year 2013 Medicare Part B Premiums were downloaded from medicaid.gov.9 Premiums paid on behalf of qualifying individuals (QIs) were excluded; these premiums are 100% federally funded.

2. Assuming a 52% increase following the increase of monthly Medicare Part B premiums from $104.90 to $159.30.

3. Based on Federal Fiscal Years 2016 and 2017 FMAPs from Federal Funds Information for States issue briefs. 6,7

4. Values have been rounded.