One estimate of cancer treatment costs for public safety officials in the United States puts the total over $2 billion.1 The presumption that cancer incidence in public safety officials is a result of employment and should therefore be reimbursable under the workers' compensation system represents a significant shift of costs from the healthcare system to the workers' compensation system.

The real and apparent dangers firefighters face when they enter a burning structure has made determining whether a call-related injury is covered under workers' compensation, for the most part, clear-cut—at least until relatively recently. Over the years, a handful of studies have explored a link between firefighting duties and some cancers. While the research has had inconsistent outcomes, legislatures have moved forward to expand workers' compensation benefits. This development is likely to put some risk pools, which administer benefits for public entities, at the center of discussions about coverage. Understanding the potential implications of presumption laws—the magnitude of liabilities and the potential impact on surplus—can focus discussions on a practical course of action.

Coverage

A turning point in the shifting sands of workers' compensation coverage for firefighters occurred after September 11. Firefighters running into burning buildings as people were running out resulted in a changed attitude toward the profession. The public wanted to respond by recognizing and rewarding these acts of heroism, and state officials began to feel the heat. State presumption disability laws—which redefine workers' compensation benefits for firefighters and other public safety officials—were expanded in many states.

Among their various provisions, these state presumption disability laws place the burden of care for treatment of cancer on the employer rather than the employee as is the case under health benefits. The presumption is that the cancer was a result of employment.

Legislation

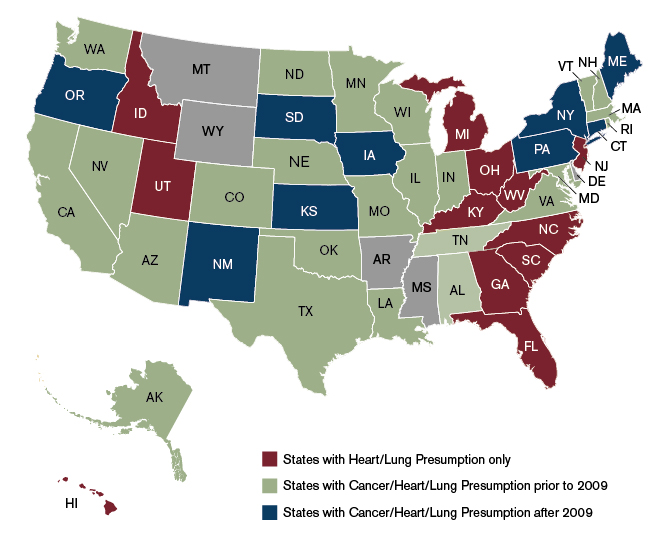

Workers' compensation benefits have historically been provided for firefighters suffering from heart and lung disease (e.g., heart/lung presumption) in nearly all states. In 2009, 24 states had firefighter work-related presumption legislation related specifically to cancer. The presumption laws in each state varied considerably on such items as types of cancers covered, eligibility, employment status, age, and service, among other provisions. In the last five years, several more states have been exploring and adopting this expansion of the law.

For example, new legislation was introduced in New Hampshire in 2013 (HB 1489) that would extend the presumption to include cancer disease effective July 1, 2014. Lawmakers seek to fund the bill by applying an assessment to all commercial and residential insurance policies issued, or perhaps an alternative approach based on the work of a special committee.2

In Michigan, Senate Bill No. 211, which puts forward a cancer presumption law for first responders, was passed by the state senate; a separate measure was introduced to the state house. The bill lists specific cancers that would be considered as presumptive conditions and establishes an employment length threshold. Money would be allocated from the general fund, and not a new revenue stream.

Pennsylvania approved a firefighter cancer presumption law in 2011 that provided a remarkably broad mandate, including among its provisions any cancer, retroactive coverage, and any employment status. After its passage, there was a significant spike in reported claims and a steep rise in costs. Insurers appear to want a “do over,” and the legislature is considering amending the law to ensure that carriers continue to provide coverage in the state.

Connecticut, Iowa, Kansas, Maine, New Mexico, New York, Oregon, and South Dakota have all enacted firefighter cancer presumption laws since 2009, and many other states have made changes to their presumption laws, as shown in Figure 1.

Figure 1: State Presumption Laws Before and After 2009

The question of who pays for the presumption benefits is a sensitive issue. When the costs are passed on to somewhat related parties (such as property policyholders), or perhaps spread across all taxpayers, the transparency starts to become muddy. Should the insurance policy have a separate line item: "Firefighter Benefit"? Or if funding is intended to come from general revenue, will taxpayers be able to see and recognize the assessment? Further, this funding provision could be contested. In California, for example, lawmakers intended that the state should reimburse local governments in the initial cancer presumption law, but a dispute between city and state ended this arrangement.

Costs

Employees injured in the workplace receive benefits in addition to the reimbursement of medical expense, including paid leave, modified work accommodations, rehabilitation/retraining, special death benefits, and extensions of pension benefits. Further, additional benefits may also need to be paid if a claim is deemed workers' compensation under the “death in the line of duty” statutes.

As more states start to adopt new or changing presumption laws, the need to understand the cost implications rises for local governments and private sector parties that employ individuals as firefighters. Armed with this information, municipalities and other affected parties can participate in the discussion from the onset, and help shape the legislation to best meet the interests of both the public safety officials and the public.

Indeed, the shape of the provisions in the presumption laws, and consequently their potential cost, vary greatly from state to state. Parameters around age limits, minimum lengths of service, and post-employment eligibility can be used to narrow or expand coverage and, in tandem, the cost of the benefit.

Eligible population: Eligibility under presumption laws is vastly different among states. Some state laws cover career and volunteer firefighters; others also include emergency medical technician (EMT) workers and other types of public safety officials. A slight distinction in eligibility can expand coverage for hundreds and thousands of people. Further, the inclusion of volunteer firefighters triggers potential complications with regard to cancer exposure from duties not related to firefighting, interpreting minimum service requirements, and “lifetime” membership status (i.e., never retired), among other issues.

Cancer type: The presumption laws that propose to cover all cancer types pose a nearly insurmountable task of quantifying the impact, given the fact that more than 200 different types of cancer can develop in the body. The array of possibilities is exponential considering cancer can develop from almost any type of cell in the 60 different organs in the human body. Listing specific cancers in presumption laws greatly increases the usefulness of medical statistics in estimating claim costs and understanding the underlying incidence and mortality and treatment patterns of the specific illness.

Which cancers have the highest incidence rate? Which cancers have the highest mortality rate? At what age does the cancer generally develop? How long is the treatment period? What is the first-year cost of treatment? What are the ongoing costs? Which cancer treatments require time out of work, and how much time will be lost from work? Each of these questions needs to be answered, and the answers may change as we specifically consider firefighters and other public safety officials in particular states.

The answers, however, are far from straightforward. For example, prostate cancer has a very high incidence rate in the general population compared with that for thyroid cancer, which is among the lowest. Testicular cancer, which has the youngest diagnosis at age 33, has implications related to an analysis of firefighters who are still in the workforce, while bladder cancer, which has the highest diagnosis at age 73, has implications for retired firefighters. Lung and bronchus cancers have the highest death rates, with colon and rectum cancers’ mortality rates following next. Multiple myeloma is one of the most expensive cancers to treat whereas melanoma of the skin is the least costly. Surveys completed have estimated employed respondents undergoing active cancer care missed 22 more workdays per year compared with lost time for those without cancer. Differences in incidences, survival rates, and lost time among other factors need to be part of a cost analysis.

The National Cancer Institute supports the program Surveillance, Epidemiology, and End Results (SEER), which is the source of the above information and more on cancer incidence and survival in the United States. While this information is useful in evaluating the frequency of claims, the target population of presumption laws is only public safety officials. These statistics on the general population therefore may not be, as implied by the legislation, applicable.

Treatment costs: The cost of cancer treatment is, unfortunately, not compiled by a trusted source, in a similar succinct manner. While SEER has some benchmarks for medical costs, more extensive research needs to be done to further identify and quantify the cost impact on the local governments. The first-year, intermediate, and last-year cost of treatment, the length of treatment, and the medical costs in a particular geographic area are just some of the important considerations. In addition, cancer diagnosis is a devastating reality and patients and providers often have the tendency to seek extraordinary or experimental treatments at any cost, regardless of the proven efficacy.

Prior injuries: Some presumption laws are proposing to provide coverage for past incidences of cancer to all firefighters and other public safety officials, either on an unlimited basis or with some specified number of years. These benefits would generally include lost-time pay, death benefits, and reimbursement for medical costs. Public safety officials who have served more than one day (or minimum service) would be entitled to a presumption that their cancer is job-related, regardless of when the cancer was diagnosed or treated within the retroactive period.

The introduction of retroactive coverage makes the estimation of the cost impact of the law more difficult to calculate. First, a history of the eligible population may not be readily available. For example, a municipality would need to identify each volunteer and career firefighter who served in a firefighting capacity in the municipality since the retroactive date. Also, characteristics of those insureds (including age, sex, and ethnicity among other factors) would be needed to accurately reflect the risk, and some items such as pay, time, and capacity of employment would need to be accumulated on an annual basis. A historical summary of the state’s workers' compensation program (state historical average weekly wage and benefit structure) would also be needed. An estimate of retroactive lost-time benefits would need to consider the number of diagnosed insureds; an estimate of insureds diagnosed while still working, prior to retirement; the duration of work missed that is due to treatment; and whether the disease was cured, or perhaps relapsed. Further, estimating historical medical costs, which can vary considerably based on the age of the patient as well as other health considerations, to reflect the impact of technology over time and changes in the healthcare environment is a difficult assignment.

Secondly, the introduction of retroactive coverage raises questions about which past costs should now be reimbursed by the workers' compensation system. For example, let’s consider Joe, a volunteer firefighter, who is employed as a store clerk at Good Foods and was diagnosed with prostate cancer 10 years ago at the age of 60. He works for two years while undergoing treatment. His medical costs are partially paid for by the medical plan of Good Foods. Joe incurs out-of-pocket expenses (deductibles, copays, coinsurance, etc.). Joe retires at age 62 and becomes eligible for Medicare and continues medical care for three more years until he is cured. Would the municipality reimburse Joe, the Good Foods health insurer, and Medicare? And, if so, for what dollars? Actual expenses or inflation-adjusted expenses? Would the workers' compensation carrier be entitled to a portion of the healthcare premiums that were paid by Joe? Further, while Joe may not be inclined to file a claim for the best interests of Medicare, he may not need to. The Centers for Medicare and Medicaid Services (CMS) may seek restitution on behalf of all the Medicare insureds under the Secondary Payer Act, and have precedence for doing so in other situations.

There may be a silver lining, or perhaps a gray lining, in the funding provisions in some of these presumption laws. In some states, a bill is passed as cost-neutral and the benefits paid by the municipality, and its insurers, would then be reimbursed by the state. However, in the case of New Hampshire, it is not clear that the contributions will equate to the payout (the expected costs were deemed indeterminable),3 or in the case of California where one hand giveth and the other taketh away.

The potential significant cost of presumptions under the law is a possibility that has not been lost on many legislatures. However, the magnitude of those liabilities and who will bear them have been left open, which is due to the time and expertise required to make those determinations. Legislatures may also sense that a miscalculation could lead to unintended consequences. Implementing these presumptions is vastly more complicated than the straightforward good intentions that these laws are based on.

Risk pools

For public entity risk pools, the data constraints around identifying exposure to loss, as well as the difficulties in quantifying and administering the presumption laws, is compounded when municipalities are pooled from across the state. Prospective as well as retrospective vantage points need to be sought. Despite these obstacles, the tides of the political process are shaping the landscape such that risk pools are required to navigate for the foreseeable future.

A core solution

While there are numerous limitations in any forecast of future liabilities, the development of an approach to quantify and understand the potential realm of possibilities on a pool-by-pool basis can be performed. The unknown equations may seem overwhelming, but they are manageable. In fact, determining a pool’s potential liabilities is at its core a frequency and severity problem that actuaries work with on a regular basis. While many assumptions may need to be made, which is due to lack of data, there are a number of approaches that can be used to inform pool managers of a pool’s potential liabilities, given certain parameters.

One approach in addressing presumption disability laws that begin to surface is to undergo a process of education on the purpose, players, and parameters, and consider relying on experts to help put a price tag on the potential future costs. The first step is to understand the universe of exposure. Collect the data from all member municipalities on their public safety officials. Perhaps not available from the pool’s inception, there would most likely be some information on the number of public safety officials in each pool. Assumptions can be made to split between career and volunteer firefighters, if the data is not available, and the experience can be interpolated for unknown time periods. At that point, the exercise becomes a frequency and severity math problem. How many public safety officials will develop cancer, and what is the likelihood of filing a claim? Once a claim occurs, what is the amount of the indemnity, death, and medical payments that will be made?

The frequency parameter can consider various statistics, modified for the particular exposure. However, cancer incidence rates change over time, which can lead to distortions in long-term trends. In the early 2000s, there was an uptick in the diagnoses of prostate cancer, which some postulate was due to Rudy Giuliani’s public announcement that he was fighting the disease. The application of incidence rates would need to consider any such anomalies in the data.

The severity parameter would be broken into the three components of benefits. The indemnity payment under the workers' compensation structure hinges on pay, and current and historical pay histories may not be readily available, where assumptions around the weekly wage benefit could be applied. The timing of the diagnoses (prior to retirement) for a worker still employed, and the percent of work missed that is due to treatment, which will vary by cancer type, are important elements of the calculation.

Another benefit often received under workers' compensation is a death benefit, which is specific to each state and needs to be recognized in the event of death. However, advances in treatment have increased survival rates and may allow more public safety officials to live with cancer, well beyond retirement. The applicability of historical results as well as the various “what-if” scenarios in redefining history should be considered.

Finally, there is the cost of medical treatment, which would vary by cancer type, number of treatment years, and local medical costs and treatment facilities. Healthcare organizations produce evidence-based guidelines in treating the various types of cancer with modalities including surgery, radiation, and chemotherapy. Chemotherapy, in particular, is an expensive treatment remedy—inpatient, outpatient, and prescription drug. Studies estimate that a cancer patient receiving chemotherapy (approximately 22% of all cancer patients) incurred, on average, costs of approximately $111,000 a year, almost four times the cost of a cancer patient not receiving chemotherapy.4 Further, chemotherapy costs can fluctuate significantly each year as new agents are utilized.In evaluating costs, it is critical to understand the prescribed course of action by cancer type. For example, about half of lung cancer patients receive chemotherapy in any given year as early-stage lung cancer can be treated with surgery. Unfortunately, most cancer treatments are only minimally effective, and there may be differences in utilization, and ultimately costs, based on the payor system.

The combination of these items—the incidence rates applied to the indemnity benefits and treatment costs, and mortality rates applied to death benefits—would generate an initial expectation of costs. From there, the results would be subject to scenario testing, where each parameter is adjusted based on actuarial judgment, in an effort to highlight the sensitivity of the assumptions to the overall costs.

The pools should also consider introducing parameters into the legislation that tailor the goal of providing benefits to only the appropriate situations. Minimum service requirements, preemployment qualifications, annual physicals and health screenings, and mandatory use of safety equipment, among other provisions, will ensure that the presumption is applied in cases that truly merit coverage.

One further consideration lies in apportioning liability. Firefighters—unlike police—tend to move frequently between departments through their careers. Also, municipalities can and will change their pool memberships, frequently or infrequently, and move in and out of various pool arrangements, or even commercial market coverage. How do you establish a time of manifestation of the cancer disease, and how is that attached to an employer and, ultimately, the payor—the insurance policy? Is it a claims-made type attachment, where the policy in effect responds once the claim is made? Or is it an occurrence policy, where the policy in effect at the time of the occurrence responds?

In workers' compensation, the “last injurious exposure rule” often governs this assignment of risk, where the last employer to expose the employee to the condition assumes the entire risk of loss, assuming that this rule applies in the state. If not, manifestation of the disease can culminate over years and years of carcinogen exposure. Who pays then? Perhaps a horizontal allocation of all policy limits in effect across all pool years would contribute to the “bathtub.” As this is a hurdle in asbestos manifestation, years of litigation of assigning responsibility still remain unsettled more than 40 years after the problem surfaced. Some rigor around this discussion would be diligent on the part of the insurance community.

Lastly, the financial position of workers' compensation risk pools needs to be considered at the onset, which is due to the fiduciary responsibilities of not only the management but the regulators. Once a new liability is introduced, the member-rating algorithm will need to be revisited (including any caps on rate increases) and reserves will need to be established to reflect potential future payments. To the extent that liability is not known, whether from being unable to quantify or unable to confirm responsibility, a contingent reserve may be a more appropriate approach. However, it would have a different accounting treatment (i.e., it would not be a liability). In instances where coverage is applied retroactively, member contributions collected in prior years had no provision for this liability, which opens the door for potential retroactive assessments. Further, the estimated reserve can be a significant increase in the liability side of the balance sheet on day 1, impacting the viability of the pool. If the financial burden to workers' compensation pools is too great, the introduction of new presumption laws that provide benefits to one segment of the workforce may in fact deprive other workers of coverage for work-related injuries.

This evaluation process is a stepping-stone to a deeper understanding of a pool’s potential liabilities and, ultimately, the knowledge to effectively manage these new risks. Working through the maze of issues can result in insight necessary for pool managers to effectively participate in the political process, and, upon resolution, negotiate terms of coverage, set pricing levels, and ensure the long-term solvency of their pools.

Conclusion

Providing workers' compensation benefits to public safety officials with cancer through presumption disability laws is here to stay. The convoluted web of the political process and concern for America’s heroes is shaping the environment. The recent activity in many state legislatures greatly impacts the public entity risk-pooling community as they insure the workers' compensation benefits of their municipality members. Each risk pool needs to quantify the impact of the legislation and recognize the new risks it is assuming to avoid getting burned.

1Estimate based on Forbes February 2014 U.S. total healthcare spend; Milliman study of 2007 Medstat data; and estimates of U.S. commercially insured population, population of firefighters (NFPA 2012), and population of other public safety officials.

2HB 1489: As introduced, "the commissioner shall establish the amount of assessment to produce the minimum amount necessary to carry out [the provision]." In April 2014, the bill was transformed via amendment to a law that creates a committee to review various funding approaches and report findings to the governor and legislative leadership.

3HB 1489 in New Hampshire: The New Hampshire Departments of Labor and Justice state that this bill, as introduced, will have an indeterminable fiscal impact on state, county, and local revenue and expenditures in FY 2015 and each year thereafter.

4Fitch, K. & Pyenson, B. (March 30, 2010). Cancer Patients Receiving Chemotherapy: Opportunities for Better Management. Milliman client report.