The CMS value-based insurance design model

Value-based insurance design (VBID) is a consistent buzzword crossing the health insurance landscape. Payers are looking for ways to improve access to care, improve the quality of care, and reduce costs for those with chronic conditions. Access is improved by reducing cost sharing for members with these chronic diseases, which may or may not be dependent on whether the member participates in the payer’s disease management programs. The reduction of cost sharing allows the member to receive the care specific to the chronic condition without the financial burden or impediment of cost sharing. In turn, the better access and compliance with treatment protocols should improve the quality of care through greater interaction with providers and mitigation of high-cost events like emergency room visits or inpatients stays. The Centers for Medicare and Medicaid Services (CMS) is the latest payer to investigate VBID by offering an option through the Medicare Advantage (MA) program.

Background1,2,3

CMS introduced the MA VBID model test for calendar year (CY) 2017. The model test allows MA plans to offer supplemental benefits or reduced cost sharing to members with specified chronic conditions. VBID is a five-year program to test whether higher quality and more cost-efficient care is achieved.

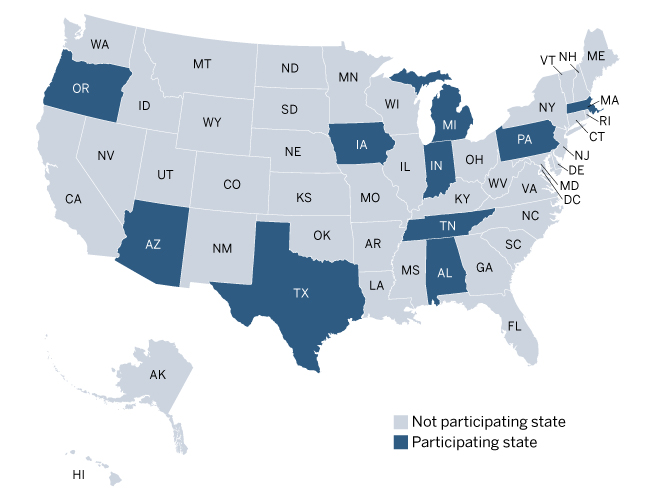

CMS just introduced the changes to the VBID model for CY2018. The changes include new states and new targeted clinical conditions. The chart in Figure 1 shows the participating states.

Figure 1: VBID states

The states selected by CMS were generally representative of the national MA market. Overall, the states include urban and rural markets, low and high average costs, low and high low-income prevalence, and varying levels of MA penetration and competition. Alabama, Michigan, and Texas are new in CY2018.

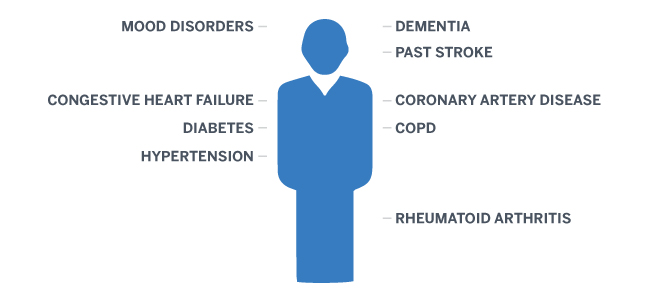

The chart in Figure 2 shows the targeted conditions. Rheumatoid arthritis and dementia are new in CY2018, and CMS will allow a more restrictive definition of the mood disorders condition.

Figure 2: VBID targeted conditions

CMS selected the targeted conditions based on their prevalence, their potential for high-cost complications, and the availability of low-cost, high-value interventions. MA plans may choose to include one or more targeted conditions.

For each of the targeted conditions, MA plans may design their own interventions; however, they must fit into one or more of the categories shown in the chart in Figure 3.

Figure 3: VBID interventions

The blue shaded boxes above identify the VBID categories associated with cost-sharing reductions, while the gray shaded box identifies the supplemental benefit option. MA plans may include multiple interventions, and the interventions may vary by targeted condition.

Examples of each category are noted below:

- Reduced cost sharing for high-value services: Elimination or reduction in vision exam copays for diabetics.

- Reduced cost sharing for high-value providers: A primary care physician (PCP) participating in an accredited medical home or heart disease patients choosing to have nonemergency surgery at cardiac centers of excellence.

- “High value” should be determined by the MA plan, using independent, external metrics. These providers should be identified by cost, coding accuracy, or intensity.

- Reduced cost sharing for enrollees participating in disease management or related programs: Elimination or reduction in PCP copays for diabetics who meet with case managers or complete a health risk assessment (HRA).

- Clinically targeted supplemental benefits: Supplemental tobacco cessation for COPD patients.

“Value” in VBID not necessarily about cost savings

The MA program utilizes an annual bid process so MA plans can demonstrate their value to CMS. The bid projects historical costs, adjusting for trend, program changes, managed care initiatives, and population changes, and reflects the proposed cost sharing (generally lower than Original Medicare) and supplemental benefits (those not covered by Original Medicare). The bid is separated into projected Medicare cost (claims plus administration plus profit) at Original Medicare cost sharing and non-Medicare costs. The projected Medicare costs are compared with the risk-adjusted CMS benchmarks to determine any savings. If savings exist, then the MA plan has demonstrated that it can provide Original Medicare benefits while covering its administration and profit for less than CMS can administer Original Medicare. CMS then retains a portion of the savings, if any, depending on the star rating of the MA plan. Therefore, savings can be driven by a combination of revenue increases and cost reductions.

MA plans may already be offering programs to help improve the quality of care and reduce costs, and the cost and savings of these programs may already be reflected in the bids. Introducing VBID in a bid could result in higher overall costs because cost sharing for certain services or providers related to the targeted conditions would now be eliminated or reduced.

CMS is not requiring or even suggesting that MA plans eliminate or reduce all cost sharing related to the targeted condition. Instead, the CMS examples show eliminated or reduced cost sharing for a key type of service and/or provider relevant to the targeted condition. The MA plan would want to balance the following:

- Choosing targeted conditions with a high enough prevalence to be worth the effort

- Choosing the type of service and/or provider to affect the patients’ treatment decisions with the effect of lost cost-sharing revenue and overall cost savings

In essence, CMS is allowing plans to offer a “look-alike” version of a chronic special needs plan (C-SNP) within a general enrollment plan. C-SNPs target members with specific chronic conditions, and only condition-eligible members are allowed to enroll in them. The VBID model is similar; however, there are no member enrollment restrictions. The VBID plan will continue to be a mix of members with and without the targeted conditions.

Similar to a C-SNP, a VBID plan achieves savings and profitability by properly managing the chronic conditions, avoiding high-cost episodes, and properly identifying diagnoses and reporting them. Once a chronic condition is identified in a member, it should always be present from a risk score perspective. The other side of the equation is then the MA plan’s ability to manage the chronic condition. This may be done through existing disease management programs or the introduction of new programs specifically for VBID. The elimination or reduction of cost sharing and/or supplemental benefits designed to incentivize access to providers may prove more effective than more invasive disease management programs where members have to choose to participate. However, the MA plan must still identify the cost drivers of each chronic condition and manage them through patient incentives and education, provider incentives and education, and case managers.

While the focus of the model is directly related to cost through lower cost sharing, supplemental benefits, and higher quality, a key driver of success in MA is proper diagnosis codes. The ability to use an HRA to initiate a cost-sharing reduction could result in more comprehensive diagnosis coding. Diagnosis codes are mapped to hierarchical condition categories (HCCs), which are assigned risk score coefficients. The risk score coefficients, based on diagnoses and demographics, are summed to determine each member’s risk score. The risk score is then used to calculate the CMS monthly revenue for each member. The table in Figure 4 shows the HCC coefficients for the targeted conditions.

Figure 4: HCC risk score coefficients4 for targeted conditions

| Targeted Condition5 | HCC | Coefficient* |

| Diabetes | 17, 18, 19 | 0.104 to 0.318 |

| Congestive heart failure | 85 | 0.323 |

| COPD | 111, 112, 114 | 0.209 to 0.599 |

| Past stroke | 100 | 0.263 |

| Hypertension | None | 0 |

| Coronary artery disease | 86, 87, 88 | 0.140 to 0.233 |

| Mood disorders | 58 | 0.395 |

| Rheumatoid arthritis | 40 | 0.423 |

| Dementia | None | 0 |

| *Community, NonDual, Aged. | ||

The risk score for a given year (i.e., CY2017) is based on the member’s diagnoses from the prior year. This methodology could result in a revenue and claim mismatch for newly eligible members in a VBID plan. A member may not have had the condition-triggering eligibility in the prior year so the current year's risk score and revenue would not reflect the risk of the member.

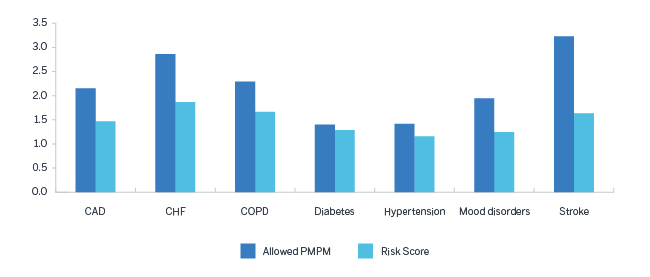

It is important to understand the predictability of the risk scores for these targeted conditions because a VBID plan may attract a disproportionate mix of members with the targeted conditions. Subsidies exist in MA plans, so MA plans need to understand how the members with targeted conditions are affecting profitability. If they are being subsidized by non-targeted members (i.e., targeted losing money, non-targeted making money), then a VBID offering could attract more targeted members or a greater proportion of them, which could result in lower profitability, assuming the VBID program does not create additional cost savings or higher risk scores. The chart in Figure 5 shows the allowed claim costs per member per month (PMPM) and risk scores for each targeted condition relative to the overall Medicare population, based on fee-for-service Medicare data (i.e., beneficiaries not enrolled in Medicare Advantage plans). This data would not reflect the impact of coding improvement initiatives that most Medicare Advantage plans have implemented.

Figure 5: Claim costs PMPM and risk scores by targeted condition relative to the average*

* Medicare 5% sample for CY2014; nationwide, non-end-stage renal disease (ESRD), non-hospice, non-dual, noninstitutionalized.

The correlation between the claim costs and risk scores is greatest for the diabetes and hypertension targeted conditions. Generally, the risk scores are not good predictors at very low and high levels because the risk score methodology regresses to the mean. Alternatively, there could be potential for additional managed care savings and coding on the higher-cost conditions, which would be necessary to achieve or maintain profitability.

Finally, the programs and savings should be sustainable over time. MA plans should clearly understand the drivers of any savings on the targeted members and determine whether the initiatives driving these savings are sustainable. They should also ascertain how sensitive the financial results are to the mix of business between targeted and non-targeted members.

The chart in Figure 6 shows the steps to effectively implement, monitor, and refine a VBID plan.

Figure 6: VBID program development cycle

CMS will review the proposals to determine if they meet the goals of the program: improved member outcomes and satisfaction, lower out-of-pocket costs, lower costs for MA plans, and ultimately lower bids over time.

Impact of VBID and the future

VBID provides MA plans with opportunities to differentiate themselves in the market. They can demonstrate their innovation through sales and marketing of VBID. While this will not affect every member, the senior market is very active and communicates often with each other, especially when it comes to insurance.

As with any new program, the requirements will evolve based on the feedback from stakeholders. Communication between targeted and non-targeted members and CMS will be critical to the success of the program. This will add a layer of complexity of monitoring and reporting to an already compliance-heavy program.

As noted above, the model test begins in 2017 and is currently set for five years, ending in 2021. During the model test, CMS will evaluate further changes that could affect the targeted conditions, interventions, member marketing/communication, or more stringent financial requirements. In addition, the new program creates new potential for audit and corrective action plans for noncompliance.

Next steps6

Eligibility is defined by CMS, which will issue the annual Request for Application (RFA) this fall, likely September. The RFA will likely be due later this year and require MA plans to identify the applicable state and Plan Benefit Package (PBP). MA plans will identify targeted conditions, interventions, and how they expect to achieve higher quality and/or lower costs through their offerings. Actuarial projections will be required to show the impact on member premium as well as utilization and cost. The projections must show net savings to CMS and no net increases to enrollee cost over the life of the model. Consideration will be given to the reasonableness of the assumptions, the positive or negative impact on members, the impact on non-VBID supplemental benefits, and sustainability. Once approved, CMS will expect the assumptions to be incorporated into the following year’s bids unless the MA plan formally requests withdrawal prior to the bid submission.

Summary

Like other payers, CMS is investigating potential savings from VBID through MA. MA plans need to assess the risk of offering VBID. This assessment should include an understanding of the following:

- Administration (i.e., offering different benefits for members in the same plan)

- Cost drivers for each targeted condition

- Diagnosis coding opportunities

- Impact of lost cost-sharing revenue

- Opportunities for interventions (i.e., services for which cost sharing should be eliminated or reduced)

- Opportunities for savings through improved provider access or provider steerage

- Subsidies between targeted and non-targeted populations

- Sustainability

MA plans should proceed with caution as there could be unintended consequences related to VBID, such as the potential impact on star ratings, marketing confusion, and/or unforeseen administrative costs.

In the end, VBID is an opportunity and each MA plan must weigh the costs and benefits of offering it to their members. Prudent evaluation should help to minimize risk and lessen surprises.

1CMS.gov. Innovation Center: Where Innovation Is Happening. Retrieved September 14, 2016, from https://innovation.cms.gov/initiatives/map/index.html#model=medicare-advantage-value-based-insurance-design-model.

2CMS (September 1, 2015). Announcement of Medicare Advantage Value-Based Insurance Design Model Test. Memo from Sheila Hanley, Director of Policy and Programs Group,

3CMS (August 10, 2016). Medicare Advantage Value-Based Insurance Design Model Test – Advanced Notice of CY 2018 Model Changes. Memo from Hoangmai Pham, MD, MPH, Acting Director of Policy and Programs Group.

4CMS (April 4, 2016). Attachment VI: Announcement of Calendar Year (CY) 2017 Medicare Advantage Capitation Rates and Medicare Advantage and Part D Payment Policies and Final Call Letter.

5CMS published diagnosis codes in VBID-ICD10-codes-10-9-2015.xlsx and mapping to HCCs in Final ICD-10 HCC and RxHCC Mappings.xls.