The challenge

Making retirement decisions easier to understand is critical to increasing plan participation and deferral rates in employer sponsored 401(k) plans. If people do not take advantage of them, 401(k) plans have little to no value.

A banking client of Milliman wanted to develop a creative communication campaign for their participants on the importance of saving for a secure retirement through the workplace. The campaign needed to address the following key issues:

- The bank froze their defined benefit plan due to the financial challenges it faced after changes to legislation.

- The bank had a strong desire to promote their 401(k) plan and encourage employees to increase their savings rate to become more financially secure in retirement.

- Employees were nervous about losing money due to limited investment knowledge and recent downturns in the market. This lack of investment knowledge decreased rates of participation.

The solution

Utilizing data from hundreds of plan sponsors, and thousands of plan participants, as well as robust analytic tools, the Milliman employee communications team proposed the use of a targeted communication campaign called a GAP analysis.

Participants within the campaign received a GAP letter based on their specific eligibility through direct mail. This letter was sent to each employee and included information that would help them analyze their current financial situation given stated assumptions about compensation, salary deferrals, inflation, social security, and investment returns to forecast their security in retirement.

The overall analysis showed that only 63% of the employees were on track to meet their retirement income needs. This was an eye opener to the plan sponsor and participants. The bank now had a better understanding of their employees’ educational needs, leading to the next step in the campaign. Following the GAP analysis, Milliman education consultants conducted in- person one-on-one meetings with employees of the bank, discussing topics such as:

- When will I have enough money to retire?

- How much money do I need in retirement?

- How much should I contribute now to meet my goals?

- Overall investment education

- Rolling money into the plan from prior employer sponsored plans

- Retirement distribution options

The outcome

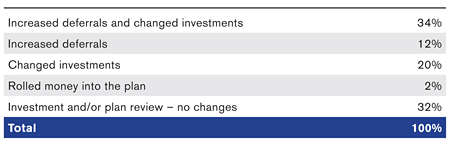

The effectiveness of GAP letters and individual meetings was astonishing. The communications campaign improved the plan’s participation rate and helped participants make important retirement planning decisions. Below are the results:

Our experience has found that a combination of in-person educational and written communications leads to increased responsiveness by participants in making positive changes to their retirement strategies. 46% of employees that had a one-on-one meeting increased their contribution rate. With the help of investment education, participants are able to make well-informed decisions and changes to their investment portfolio to align their risk tolerance with their retirement date. As a result of education and communication, participants in company sponsored retirement plans have an increased awareness of the importance of saving for the future and a better understanding of investing for retirement.

After the success of the meetings, the bank decided to continue with a strong communications and education program for the years to come.