Student loans have been headline news in recent months.1 Student loan debt outstanding in the United States is approaching $1 trillion and surpassed outstanding credit card debt for the first time in 2011.2 The persistent high unemployment rate in the United States is making student loan debt a difficult burden for many recent graduates. There is a political debate concerning the interest rates charged on student loans, and many news stories include narratives of students with large amounts of student debt and little prospect of finding a commensurate job. Some reporters and commentators have dubbed student debt “the next subprime.”3 This comparison certainly grabs a reader’s attention, and it may cause readers to ask: Does student loan debt in the United States have the potential to cause a similar amount of financial damage as the mortgage crisis?

Student loan debt outstanding

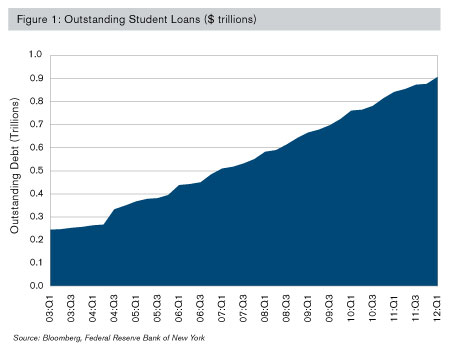

From 2003 through 2011, outstanding student loan debt increased from approximately $250 billion to over $900 billion (Figure 1), outpacing the growth rate in outstanding debt for credit cards, auto loans, and mortgages over the same time period. The rise in student loan debt over this time period can be attributed to increased tuition costs, governmental initiatives to encourage funding for higher education (e.g., the Federal Direct Student Loan Program), an increase in for-profit proprietary schools, and a tendency by recent graduates to seek a second degree if they are unable to find a full-time job, among other reasons.

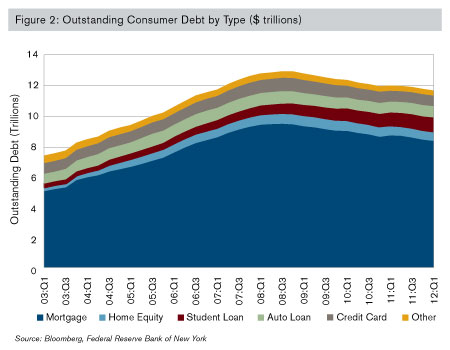

Figure 2 provides a visual representation of outstanding consumer debt in the United States from 2003 through 2011 for all categories of household debt.4

While student loan debt ranks second on the list of consumer debt with 7.9% of total debt outstanding as of year-end 2011, total mortgage debt makes up approximately 76.9% of total debt outstanding. However, the size of debt outstanding is just the starting point in analyzing whether a particular credit market may cause turmoil in the financial markets. More important is the amount of the potential credit losses that may arise from the loans.

Delinquency trends

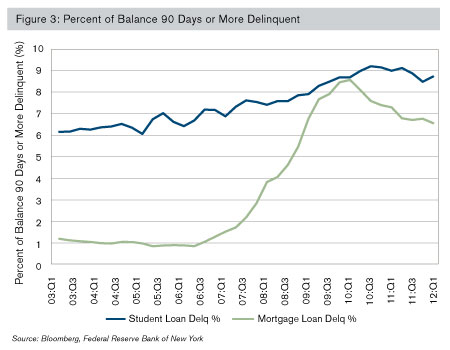

A comparison of the historical delinquency trends between the two types of credit could provide an indication of whether or not student loan debt has the potential to be the next “subprime” crisis. The delinquency rate for seriously delinquent student loans (defined as the balance of loans 90 days or more delinquent divided by the total balance of outstanding loans5) has been steadily climbing from about 6% in 2003 to over 9% in 2011 (Figure 3).

A prolonged increasing trend in serious delinquencies is likely not sustainable for any type of credit risk, and the trend will eventually have to correct. The correction may be through write-offs on principal balances or may come from better underwriting from issuers of student loans. In recent financial quarters, the percent of student loans seriously delinquent has decreased to less than 9%.

The dollar amount of seriously delinquent student loans as of December 2011 was approximately $95 billion, while the dollar amount of seriously delinquent mortgages was approximately $600 billion (down from approximately $800 billion as of December 2009). Because the outstanding balance of student loan debt is dwarfed by mortgage loans, the default rate on student loans would have to be greater than 50% on all student loans outstanding to produce a dollar amount of seriously delinquent loans comparable to mortgages. A seriously delinquent rate of this magnitude is not likely, and the potential credit loss experienced with student loans will likely be significantly less than the credit losses experienced with mortgage debt.

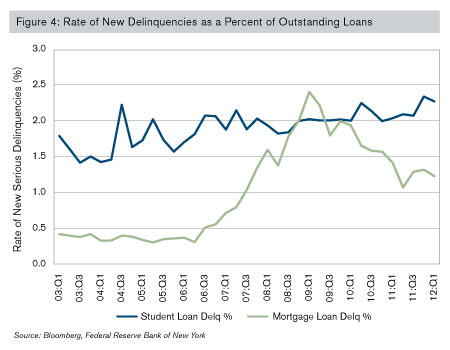

Reviewing the trend of new serious delinquencies on student loans and mortgages provides an indication of where serious delinquencies may be headed (Figure 4).The rate of new delinquencies for student loans shows, on a quarterly basis, the rate at which performing outstanding loans are transitioning to seriously delinquent loans.

A higher rate indicates that more loans are becoming seriously delinquent and is an early indicator of potentially greater credit losses. The rate of new serious delinquencies for student loans has been relatively constant since 2006 at around 2.0% but has increased over the past few quarters. The rate of new serious delinquencies for mortgages increased dramatically beginning in 2006 from about 0.4% to nearly 2.5% in 2009 and has been declining since.

Funding for student loans

A large majority of funding for student loans is supported by the government through various initiatives and programs. For the 2011 calendar year, 95% of all new student loans were supported by the government (this is an increase from 2007 when nearly 75% of all new student loans were supported by the government) either through direct lending (e.g., the Federal Direct Student Loan Program) or government guarantees for credit and interest losses on the loans (e.g., the Federal Perkins Loan Program). On average, from 1995 through 2011, approximately 10% of student loan funding has been from the private sector and 90% of the funding has been from government programs.6

The large portion of government funding for student loans means that the exposure of the private sector to student loan defaults is limited. This is in contrast to the mortgage market, where, over the past 20 years, approximately 50% of mortgage risk has been assumed by the private sector. During the build-up of the subprime crisis, the percent of mortgage risk assumed by the private sector was approximately 70%, with a significant portion of the risk being in “subprime” and second-lien mortgages. When these mortgages soured, the private sector absorbed the majority of the credit losses resulting in capital and liquidity strain for the large banks. If defaults on student loans increase, the majority of credit losses will be absorbed by the government.7

There are several governmental programs to keep interest rates low on student loans (e.g., the interest rates for loans from the Federal Perkins Loan Program are fixed at 5% and the subsidized Stafford loans are 3.4%).8 Low interest rates encourage higher education by making a college degree more affordable for students. However, affordable credit is not always a good thing (remember the housing crisis?). The interest rate charged on a loan less the borrowing cost of the investor is intended to cover expenses and provide a profit for the investor. The interest rate should be adjusted to reflect the credit risk assumed by issuing the loan. If the interest rate charged for a given credit risk is not sufficient to cover credit losses and expenses, the investor of the loan will experience a loss. If investors are reimbursed for credit losses or subsidized to keep interest rates low, then the investors have less of a concern with the credit risk of the loans. In this instance, it is economically beneficial for lenders to provide as much credit as possible to increase profits (similar to non-agency residential mortgage-backed securitizations). At the same time, low interest rates and easy credit encourage borrowers who would have otherwise decided not to use credit because the cost was too high. For example, students may borrow without fully considering how they will repay the loan (what if they can’t find a job after graduating?).

In the case of student loans, the interest rate or amount of funding provided may not be related to the credit risk of the student. For the Federal Perkins Loan Program, all students receive the same interest rate, and underwriting criteria are predominately need-based to provide funding for low-income students. This program provides a social benefit for low-income students who want to receive a higher education, and it has been decided the benefits of the program exceed the cost (otherwise, it would not have been created in the first place). However, as the student loan market grows, it may be beneficial to add more levels of underwriting to the process for this program and other student loan programs. The current levels of underwriting are not controlling for credit risk, as evident by the increasing seriously delinquent rate from 2003 through 2011 (Figure 3). For example, the type of degree or amount of other debt the student has may not currently be a part of the application process for a student loan, although such information may be highly correlated to the student’s eventual ability to repay the student loan. Because a large portion of student loan debt is funded by the government, there is little incentive for loan originators to increase their underwriting efforts. The student loan market may benefit from underwriting initiatives like those prevalent in the insurance and mortgage markets.

For-profit proprietary schools

A trend in student debt that is reminiscent of the growth in subprime debt is the recent growth and amount of debt in for-profit proprietary schools. Because the schools are for-profit organizations (and several are publicly traded) there is the potential for a conflict of interest in admitting students to increase revenue/profit and screening out students who may not be prepared for a higher education. The average debt per student for these schools is generally three to four times higher than comparable public universities and one and a half to two times higher than comparable private non-profit universities. About 95% of students use debt to finance their educations at for-profit schools compared to 60% and 70% for public and private non-profit schools. For students who do finance their educations, students at for-profit schools finance 99% of their educations while students at public and private non-profit schools finance 70% and 85% of their educations, respectively.9 Consequently, the default rates for for-profit schools are roughly two to three times that of public and private universities.10

Student loans used for for-profit proprietary schools are a growing proportion of outstanding debt. This type of borrower is similar to the subprime borrower during the build-up in the mortgage crisis with respect to having both higher levels of debt and default risk compared to other borrowers. Special consideration could be provided to these borrowers in the underwriting process of a student loan to mitigate the potential credit risk of the borrowers. One potential solution to lower the default rate for these borrowers could be to require the borrower to pay for a larger portion of the tuition upfront and provide a loan for the remaining portion. This way, the student is required to save for the education and has put more time and effort into the decision to seek higher education. This concept is similar to the down payment in mortgage lending. In general, borrowers with a higher down payment have a lower likelihood of defaulting compared to similar borrowers with a smaller down payment.

Proprietary schools have received political attention for high student loan default rates in recent years and changes to the current system may occur. An example of one proposed change is a proposal for decreased funding for schools with higher-than-average default rates.

Insights

Student loan debt is a growing segment of consumer debt. It is not on the same scale as mortgage debt, nor does this market have similar potential direct losses to the private sector as the majority of credit losses on student loans will be absorbed by the government. Therefore, the student loan market is not likely to be categorized as the next “subprime crisis.” However, the full impact of ballooning student loan debt on consumers is currently unknown, and the burden may have an adverse impact on the purchasing power of borrowers and cosigners in the future.

Serious delinquencies on student loans have been trending up since 2003 and the growth rate in student loan debt has outpaced all other types of consumer debt over the past 10 years. Changes to the system could be made to improve the outlook for this market and may help to quell the public prodding and general concern.

Loan issuers could improve their underwriting process by implementing risk management techniques similar to those in the mortgage and insurance industries. For example, loan issuers could limit cumulative exposure to certain borrowers such as those from for-profit schools, those with a history of poor academic performance, or those in two- and three-year degree programs.11 Issuers could also limit the amount of financing provided to higher risk borrowers and require them to fund a larger portion of their educations. Such reforms could improve the credit quality of student loans but may also have the unintended consequence of limiting the number of students receiving a higher education.

Similar to mortgage reforms, originators of government-funded or government-insured student debt could have “skin in the game.” This could help prevent lenders from providing oversized education loans to students with limited earnings potential. Other ideas being offered to improve the student loan market include debt forgiveness and relating the amount a borrower can repay in a given year to their earnings in that year. These solutions will lighten the debt burden for current borrowers but may not solve the long-term credit quality concerns going forward. The problem of providing credit to those whose who may not be able to repay the debt would still exist.

Reforms could also be implemented at the borrower level. For example, student loan borrowers should be educated to understand the potential consequences of financing their educations. Before taking out a loan, borrowers should be aware that student loan debt is not forgivable in bankruptcy. Borrowers who finance a large portion of their educations (e.g., above 70%) could be required to take a course in personal finance to help them budget their student loan debt upon repayment. Student loan borrowers should fully understand their options for repayment if they are unable to find a job after graduation.

Reforms such as these will need time to take hold and provide relief to this credit space. While the impact of such reforms remains uncertain, such changes could improve the current student loan environment of rapid credit expansion and increasing serious delinquency rates.

1 Martin, A.W. & Lehren, A.W. (April 13, 2012). A Generation Hobbled by the Soaring Cost of College. The New York Times. Retrieved May 28, 2012, from http://www.nytimes.com/2012/05/13/business/student-loans-weighing-down-a-generation-with-heavy-debt.html?_r=2.

2 Federal Reserve Bank of New York, Bloomberg.

3 Villani, K. (April 3, 2012). Are student loans the next subprime debacle? Bank Think, American Banker. Retrieved May 28, 2012, from http://www.americanbanker.com/bankthink/are-student-loans-the-next-subprime-lending-debacle-1048075-1.html. Hutchinson, M. (April 5, 2012). The student loan bubble is the next subprime. Wall Street Examiner. Retrieved May 28, 2012, from http://wallstreetexaminer.com/2012/04/05/the-student-loan-bubble-is-the-next-subprime/.

4 Federal Reserve Bank of New York’s May 2012 Quarterly Report on Household Debt and Credit.

5 The seriously delinquent rate does not include loans in forbearance or in deferral. Therefore, the seriously delinquent rate in Figure 3 is potentially understated for student loans.

6 College Board Advocacy and Privacy Group. Trends in Student Aid 2011. Available from http://trends.collegeboard.org/student_aid/.

8 At the time of this writing, there is a political debate concerning the interest rate charged on Stafford loans. The interest rate on subsidized Stafford loans is 3.4%; if new legislation is not approved, the interest rate on these loans will reset to 6.8% in July 2012.

9 College Board Advocacy and Privacy Group. Trends in Student Aid 2011. Available from http://trends.collegeboard.org/student_aid/.

10 Department of Education Cohort Default Data. (November 2011). Available from http://www2.ed.gov/offices/OSFAP/defaultmanagement/cdr.html.

11 Student loan default data from the Department of Education shows borrowers in two- to three-year degree programs have a higher default rate compared to borrowers in four-year degree programs.