PENSION MODELING, MONITORING & ANALYTICS

Milliman FutureCost

Envision tomorrow’s outcomes and make smart decisions today.

Unlock the future impact of your decisions

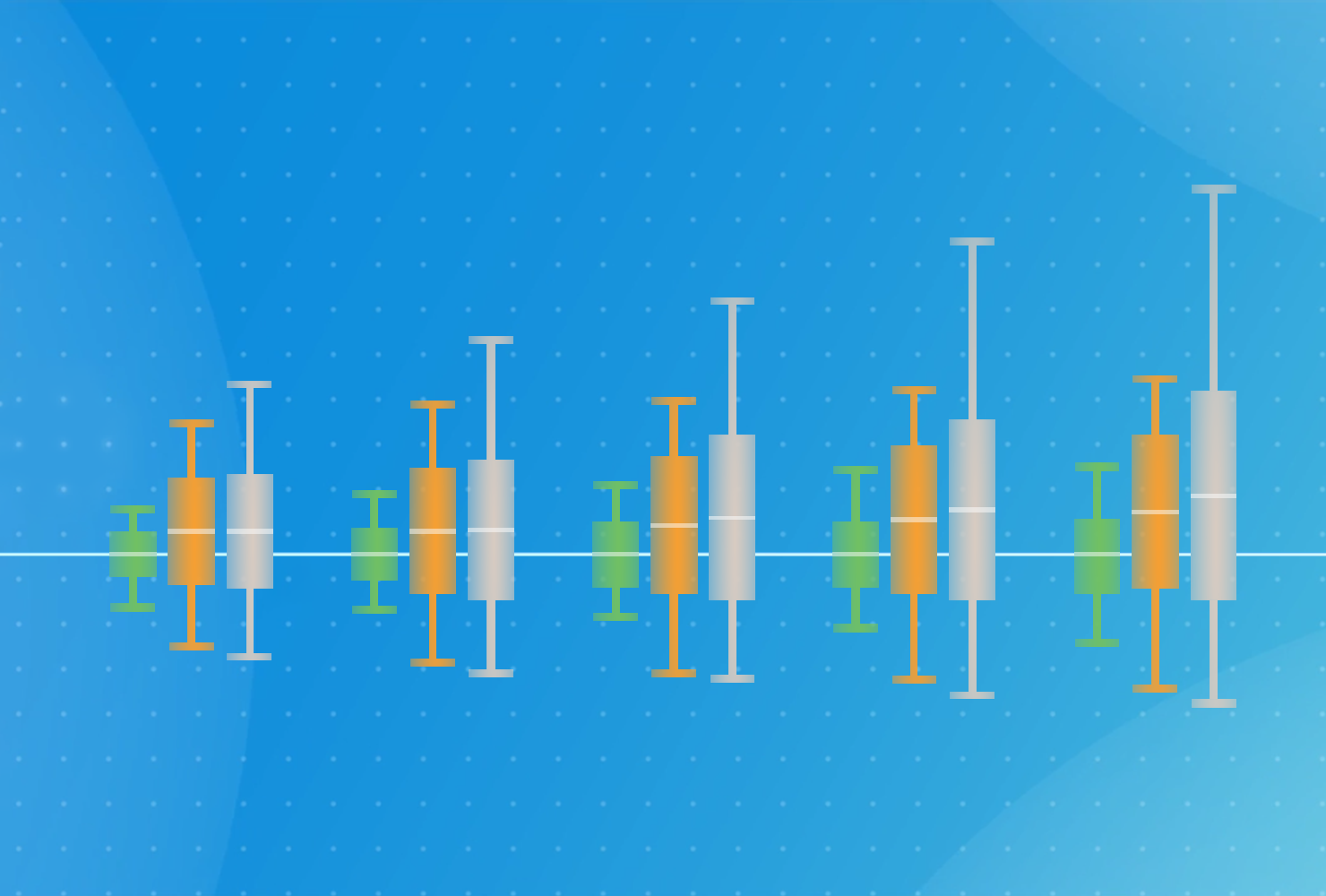

Manage short- and long-term plan sponsorship risk, understand volatility in costs and financial measures, and project long-term contribution needs with Milliman FutureCost™, a robust, web-based solution.

Stay in the know with Milliman Daily Pension Tracker

Get daily updates via email, text, or online dashboard that help you respond effectively to market trends and support liability-driven investment strategies. You’ll always have up-to-date information to support effective asset allocation and volatility management.

Choose the approaches that work for your business

Project any “what-if” scenario you can imagine based on variables including…

- Discount rates

- Asset returns

- Investment strategies

- Contribution strategies

- Benefit design

- Covered populations

Understand plan volatility and answer questions such as…

- What is the impact on the volatility of my plan by changing the investment allocation?

- How will switching to a glide path change the range of outcomes for my plan?

- What is the probability that my plan’s funded status will be above or below a key level? How does my plan’s funding and investment policy impact that probability?

- When can I terminate my plan? How do the decisions I make today impact my path to termination?

- How does a lump sum window or annuity purchase impact my plan?

Related insight

Products related to FutureCost

Pension Performance Dashboard

A complete solution for analyzing unpaid claims liabilities, combining our industry-leading stochastic modeling tools with a robust suite of deterministic reserving tools.

Milliman Daily Pension Tracker

The Milliman Daily Pension Tracker provides an accurate diagnosis of pension plans daily, allowing for plan sponsors to make prompt investment decisions to de-risk pension liability.

Milliman OPTIC

Projections at your fingertips for your multiemployer pension plan.

Services related to FutureCost

Defined benefit plan administration

Maximize the value of pension benefits to participants using our decades of experience, flexible software tools, and disciplined process.

Defined benefit plan consulting

Meet their goals and business objectives in the face of constantly shifting markets and regulations.

Frozen plan services

Implement a comprehensive, strategic approach to ensure participant benefits are paid while reducing costs.

Mergers & Acquisitions

Succeed with purchase and divestment of healthcare and insurance assets, whether a single line of business or an entire company.

Milliman Sustainable Income Plan

Get the best of both worlds with an innovative retirement plan design combining the benefits of defined benefit and defined contribution plans.

Multiemployer services

Address the issues raised by shifting demographics, increasing regulatory demands, and steadily rising costs.

Nonqualified plans

Review compensation plans for 409A compliance and communicate effectively with affected employees.

Retiree medical

Fund and manage retiree medical and post retirement benefit programs effectively and meet financial disclosure requirements.

Total retirement outsourcing

Simplify retirement plan administration while enhancing employees’ understanding and value of their retirement program.